CSU and RPM International: Partnership

Mailing Address

Cleveland State University

Monte Ahuja College of Business

2121 Euclid Avenue, BU 420

Cleveland, OH 44115-2214

Campus Location

Monte Ahuja Hall, Room 420

1860 E. 18th Street

Cleveland, OH 44114

Phone: 216-687-3786

GRC Curriculum

Curriculum content of the

Graduate Certificate in Governance, Risk Management and Compliance (GRC)

Note: All CSU accounting courses do qualify as CPE credit as a stand-alone course or if you select to complete the GRC certificate.

The program consists of four courses in addition to pre-requisite courses.

Required Courses:

- ACT 555 Internal Auditing

- ACT 565 Fraud Examination

Elective Courses:

- ACT 553 Information Systems Auditing

- ACT 575 Accounting Analytics

- ACT 632 Governance, Risk and Compliance

- ACT 690 Professional Internship*

Pre-requisite Courses: These courses are waived for accounting professionals.

- ACT 501

- OSM 503

Course Descriptions:

- ACT 555 Internal Auditing (3)

- Use of theory and practical application of internal control and internal audit for management purposes.

- ACT 565 Fraud Examination (3)

- The study of investigating, preventing, and prosecuting occupational business fraud. Includes a review of common ways occupational fraud is committed, and how to find and follow up on evidence of fraud. It also includes suggested actions and procedures to deter fraud. The course includes a review of how to conduct the investigation in a way that will best meet the requirements for criminal and/or civil prosecution. This will include a study of federal laws related to fraud examination, including various bases for prosecution, rules of evidence and the rights of the accused.

- ACT 553 Information Systems Auditing (3)

- Problems of accuracy and control in computer-oriented applications. Changing audit techniques, especially loss of traditional audit trial opportunities, control problems affected by batch systems and by direct access and real-time systems.

- ACT 575 Accounting Analytics (3)

- The analysis of data as it pertains to Accountants and Finance professionals. The focus is on analytic techniques for decision making and the examination of "big data" involving accounting information. Students will gain hands-on experience and skills with select software tools used in data analytics for accounting professionals.

- ACT 632 Governance, Risk and Compliance (3)

- This course examines the three elements of governance, risk management and control to ensure that organizations achieve their goals. It will focus on the oversight role of governance, how organizations identify, evaluate, and manage relevant business risks and establish controls to meet the compliance requirements imposed by governmental bodies, industry mandates or internal policies.

- ACT 690 Professional Internship (1-4) Permission to register must be obtained from the Accounting Chairperson early in the semester prior to enrollment in the course. Requires professional accounting work experience in an organizational environment that extends the curriculum and provides meaningful experience related to the student's area of interest.

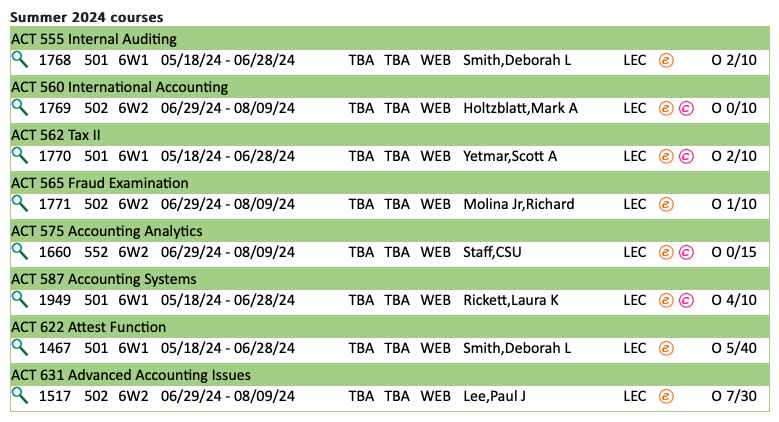

Summer 2024 Courses

Fall 2024, Spring 2025 and Summer 2025 course schedule will be released on March 1, 2024, and this website will be updated.

Mailing Address

Cleveland State University

Monte Ahuja College of Business

2121 Euclid Avenue, BU 420

Cleveland, OH 44115-2214

Campus Location

Monte Ahuja Hall, Room 420

1860 E. 18th Street

Cleveland, OH 44114

Phone: 216-687-3786